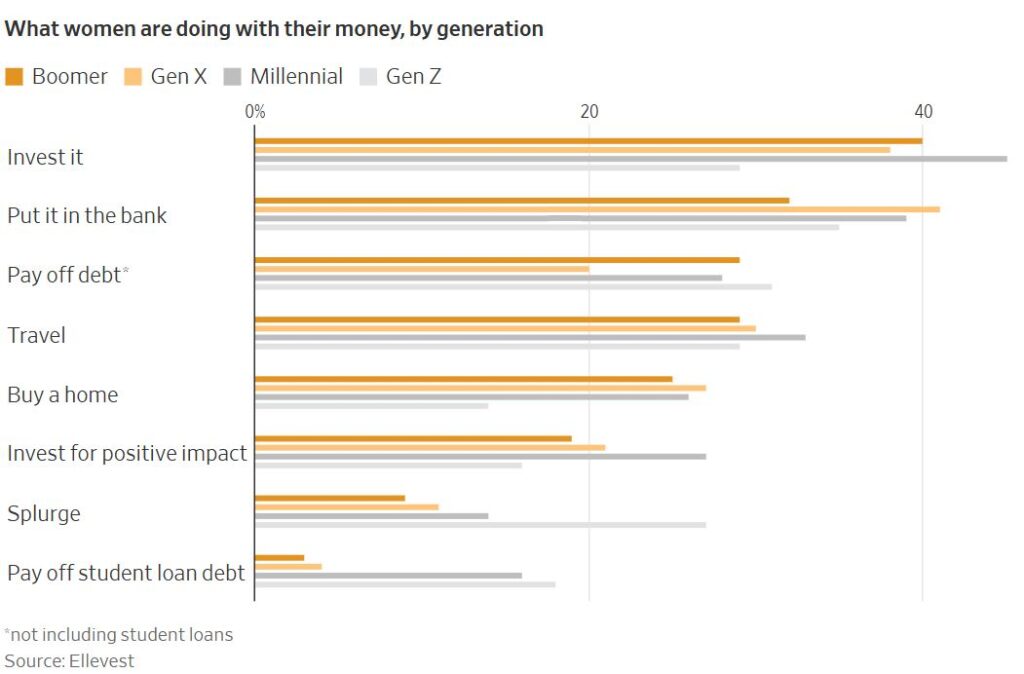

A record number of Americans turn 65 this year, and more women are set to outlive their husbands as female lifespans lengthen relative to men’s. As a result, … more Baby Boomer Women Deciding the Fate of Trillions of Dollars

Retirement Issues and Trends

Retirees With Student Debt Could Lose Some Social Security Benefits

As many as 452,000 Social Security recipients who’ve defaulted on federal student loans could be at risk of losing some of their benefits to garnishment by the Department … more Retirees With Student Debt Could Lose Some Social Security Benefits

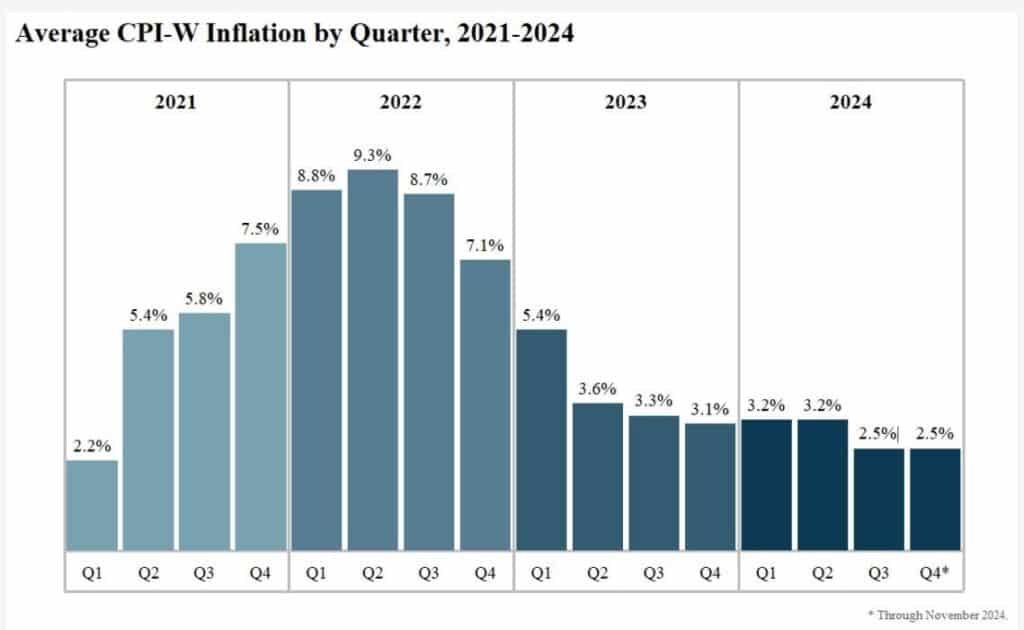

Initial 2026 Social Security COLA Prediction: 2.5 Percent

Yes, it’s admittedly way too early to accurately predict what the Social Security cost of living adjustment (COLA) for 2026 will be. But based on the latest Bureau … more Initial 2026 Social Security COLA Prediction: 2.5 Percent

Morningstar Recommends Lowering Retirement Withdrawal Rate

New research published by Morningstar recommends that retirees adjust how much they withdraw annually from their retirement accounts from the traditional “4 Percent Rule” down to 3.7 percent, … more Morningstar Recommends Lowering Retirement Withdrawal Rate

Large Share of Retirees Have Credit Card Debt

USA Today reported that two-fifths of retirees carry balances on their credit cards, according to the 2024 Spending in Retirement survey, released in November by the nonprofit Employee Benefit Research … more Large Share of Retirees Have Credit Card Debt

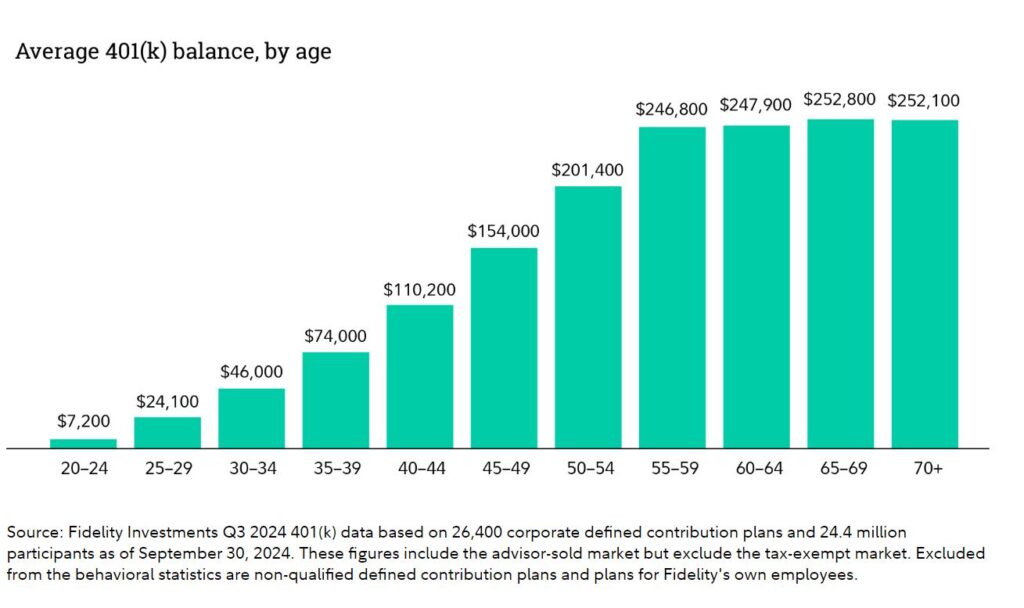

Fidelity Examines 401(k) and IRA Balances By Generation

An analysis of 401(k) and IRA accounts managed by Fidelity Investments found that Baby Boomers on average have saved $250,900 in their workplace 401(k) and $250,966 in an Individual Retirement … more Fidelity Examines 401(k) and IRA Balances By Generation

Transamerica Survey Highlights Positive Parts of Retirement and Challenges

A new study — titled “Retiree Life in the Post-Pandemic Economy” — examines the health and well-being, personal finances, and retirement security of U.S. residents who are retired … more Transamerica Survey Highlights Positive Parts of Retirement and Challenges

America’s 30 Safest and Wealthiest Retirement Towns

GoBankingRates.com ranked America’s safest and wealthiest retirement towns based on violent and property crime statistics, average retirement income for persons aged 65+, property values and a livability score. … more America’s 30 Safest and Wealthiest Retirement Towns

How AI Can Help Modernize Pension and Retirement Systems

The world is going through a seismic demographic transition, as populations age and traditional workforces shrink, prompting challenges for retirement systems that need to adapt to remain resilient. … more How AI Can Help Modernize Pension and Retirement Systems

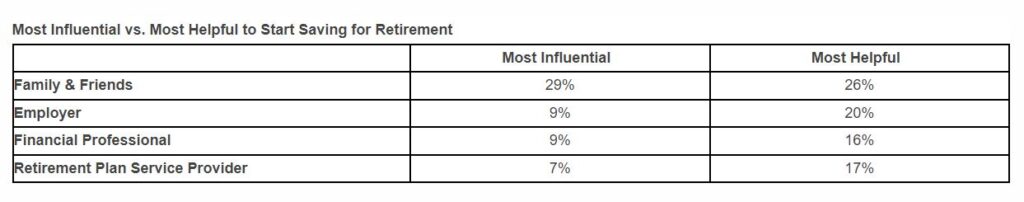

Survey: 77 Percent of Middle-Income Households Actively Save for Retirement

A new survey published by global financial services firm Principal Financial Group reveals strong retirement savings habits among middle-income households earning between $50,000-$99,999 annually. By the numbers: Seventy-seven … more Survey: 77 Percent of Middle-Income Households Actively Save for Retirement