The 2025 Planning & Progress Study, an annual research study from Northwestern Mutual, explores U.S. adults’ attitudes and behaviors toward money, financial decision-making, and the broader issues impacting … more Retirement Savings “Magic Number” Drops to $1.26M

Retirement Issues and Trends

Debt’s Impact on Older Americans

A new survey of Gen X and Baby Boomer Americans conducted by National Debt Relief reveals how soaring costs and debt burdens are delaying retirement and reshaping financial … more Debt’s Impact on Older Americans

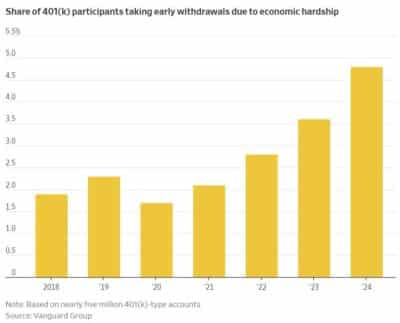

U.S. Workers Tapping Retirement Accounts At Increasing Rates

While 401(k) balances are growing, an increasing number of retirement savers are using their retirement accounts for financial emergencies. A new survey published by the Transamerica Center for … more U.S. Workers Tapping Retirement Accounts At Increasing Rates

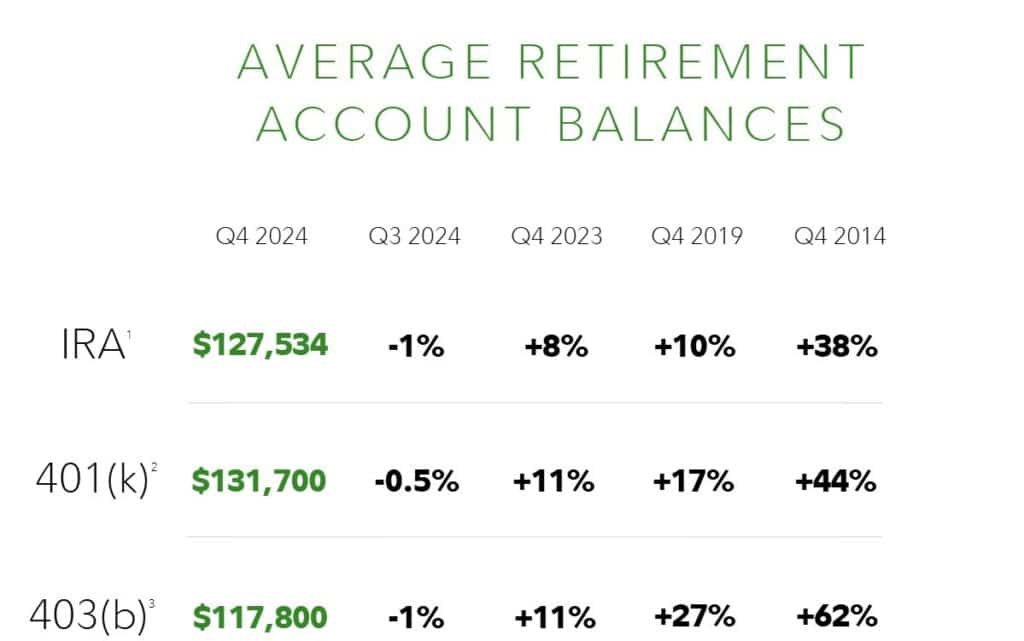

Fidelity: Retirement Account Balances Increase Year-Over-Year

Fidelity Investments’ latest Q4 2024 retirement analysis shows that retirement savers experienced a year of growth in 2024. While retirement account balances dipped slightly from Q3 2024, the average 401(k) … more Fidelity: Retirement Account Balances Increase Year-Over-Year

Thirty-One Percent of Retirees Would Consider Home Equity to Pay for LTC

As they age, retirees increasingly face the prospect of a large healthcare spending shock for medical issues or long-term care either because their health insurance involves significant cost sharing … more Thirty-One Percent of Retirees Would Consider Home Equity to Pay for LTC

States With the Most Home Equity and Retirement Savings

Nearly 60 percent of U.S. households have a net worth of $100,000 or more after accounting for debts, with 29.2 percent having a net worth of $500,000 or … more States With the Most Home Equity and Retirement Savings

A Proposal to Fix Social Security

Alicia Munnell, former director at the Center for Retirement Research at Boston College and one of America’s top thought leaders on retirement policy, published a proposal for extending … more A Proposal to Fix Social Security

97.1 Percent of Retirement-Age Americans Have Nonmortgage Debt

A new LendingTree analysis finds that 97.1 percent of U.S. adults between the ages of 66 to 71 have nonmortgage debt. Why it matters: The study examines what … more 97.1 Percent of Retirement-Age Americans Have Nonmortgage Debt

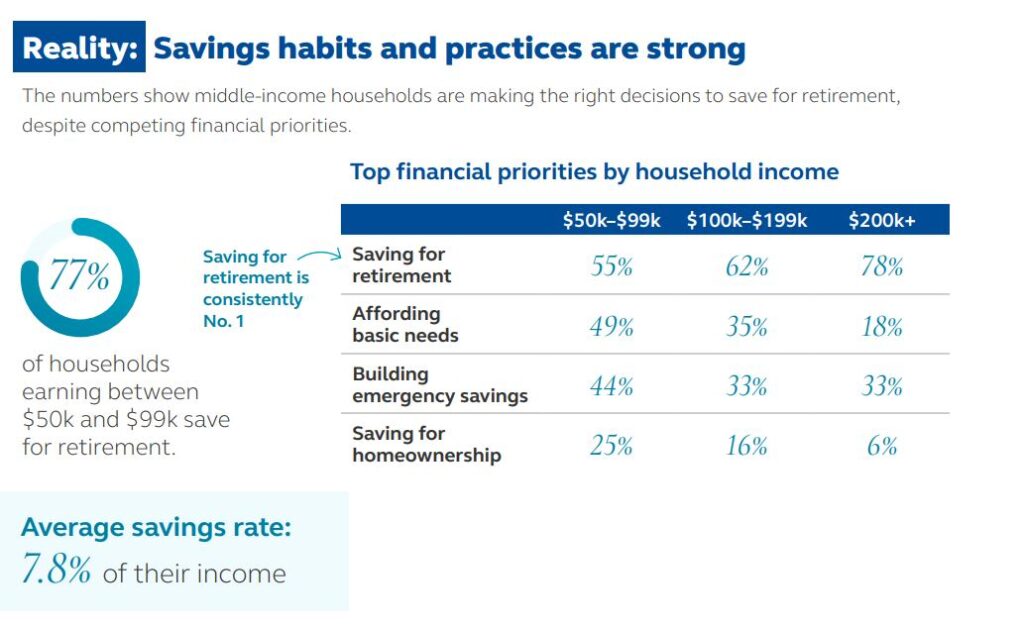

Prudential Survey Suggests Knowledge Gap Around Retirement Saving Best Practices

While saving for retirement is the top financial priority for 88 percent of Americans, a new survey from global financial company Prudential Financial Group shows a disconnect between … more Prudential Survey Suggests Knowledge Gap Around Retirement Saving Best Practices

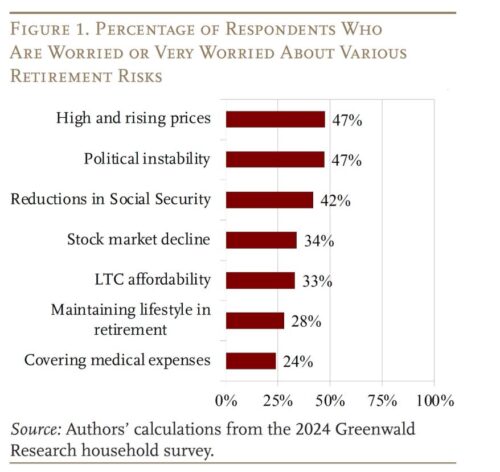

Do Older Adults Understand Healthcare Risks, and Do Advisors Help?

Despite the advice they may be getting from their financial advisors, a new Issue Brief from the Center for Retirement Research at Boston College shows that older households … more Do Older Adults Understand Healthcare Risks, and Do Advisors Help?