Over the past year, NRMLA has worked closely with Ginnie Mae to develop HMBS 2.0 to resolve the liquidity constraints that led to the largest bankruptcy in the … more Here’s why HMBS 2.0 is so important

Federal and State Regulations

Mortgagees Have 36 Hours to Report Cyber Incidents

Effective immediately, Mortgagee Letter 2024-23 requires mortgagees to notify the Department of Housing and Urban Development as soon as possible — but no later than 36 hours — … more Mortgagees Have 36 Hours to Report Cyber Incidents

HECM Loan Limit Increasing to $1,209,750 in 2025

The Federal Housing Administration has just announced that it will increase the maximum claim amount for Home Equity Conversion Mortgages in calendar year 2025 from $1,149,825 to $1,209,750, … more HECM Loan Limit Increasing to $1,209,750 in 2025

Ginnie Mae Finalizes HMBS 2.0 Term Sheet

Ginnie Mae published a finalized term sheet for its HECM Mortgage-Backed Securities (HMBS) 2.0 program. The final term sheet was developed in response to comments received and subsequent engagement with … more Ginnie Mae Finalizes HMBS 2.0 Term Sheet

Valverde Resigning as Acting Ginnie Mae President

Ginnie Mae announced last week that Acting President Sam Valverde will be stepping down effective November 30, 2024. Senior Vice President and Chief Risk Officer Gregory Keith will … more Valverde Resigning as Acting Ginnie Mae President

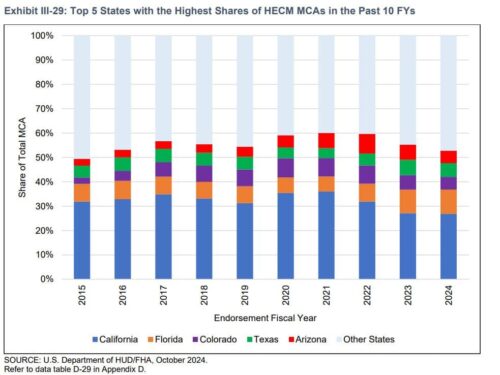

Highlights From FHA’s Annual Report to Congress

For a fourth consecutive year, the Home Equity Conversion Mortgage portfolio had a positive economic value. That’s according to the Department of Housing and Urban Development’s 2024 Annual … more Highlights From FHA’s Annual Report to Congress

FHA Issues New Flood Risk Management Standards for New Construction

Under the guidelines published in Mortgagee Letter 2024-20, all newly constructed dwellings located within the 1-percent-annual-chance (100-year) floodplain must be built at least two feet above the base … more FHA Issues New Flood Risk Management Standards for New Construction

HUD Finalizes Debenture Interest Updates

The Federal Housing Administration published updates for the payment of debenture interest on HECM claims and established a process for adjusting debenture interest for claims already filed for loans … more HUD Finalizes Debenture Interest Updates

HUD Announces Next HECM Note Sale

The Department of Housing and Urban Development published a notice in the Federal Register that announced its intention to sell 2,700 HECM notes secured by vacant properties with … more HUD Announces Next HECM Note Sale

HUD and GNMA Invited Feedback on Two Critical HECM Issues

Working in coordination with the Servicing Committee and HMBS Issuers Committee, NRMLA submitted two sets of comments, one to the Department of Housing and Urban Development and another … more HUD and GNMA Invited Feedback on Two Critical HECM Issues