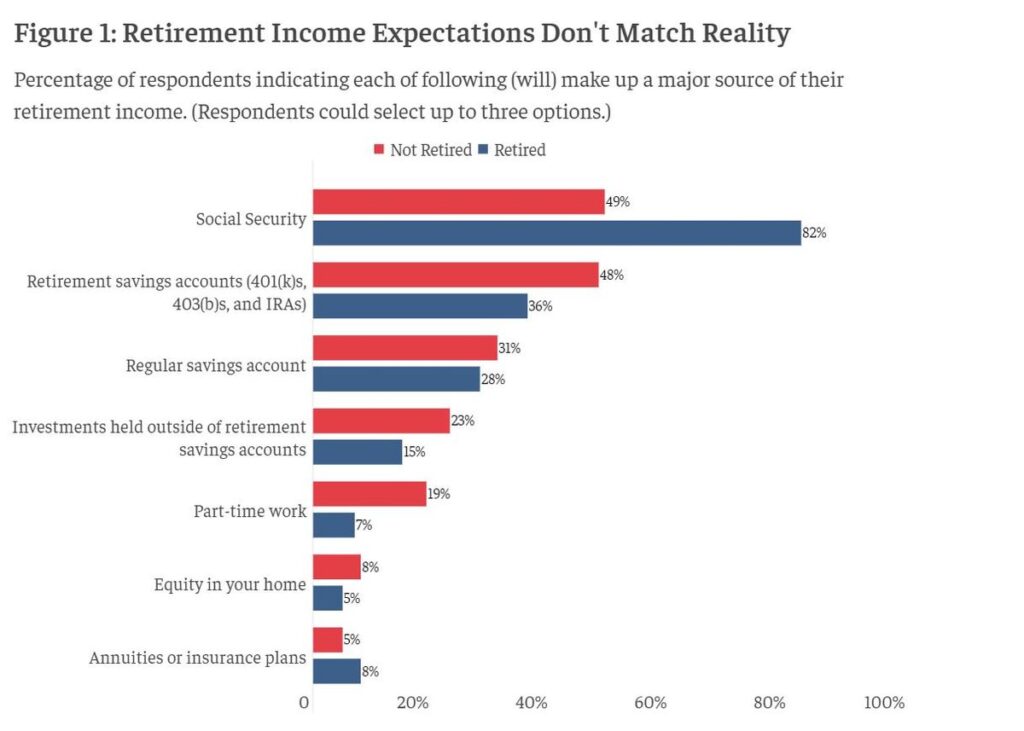

A new survey commissioned by the Bipartisan Policy Center shows a striking mismatch between the income sources workers expect to rely on in retirement and the sources of income current retirees report.

Go deeper: The largest discrepancy was related to the role of Social Security. Under half (49 percent) of non-retirees expect Social Security to be a major source of income, yet 82 percent of retirees report that Social Security does make up a major source of income, according to the BPC survey.

- Lack of awareness of how Social Security benefits work or concerns that the program will not be fully funded when younger generations retire may drive some of this effect.

The survey also found that eight percent of non-retirees expect home equity to provide a major source of funds in retirement, compared to five percent of retirees.

The bottom line: Many Americans are stressed and uncertain when planning for their retirement. This survey suggests that a key source of this rampant uncertainty is a poor understanding of what retirement looks like due to a fundamental lack of financial and longevity literacy.