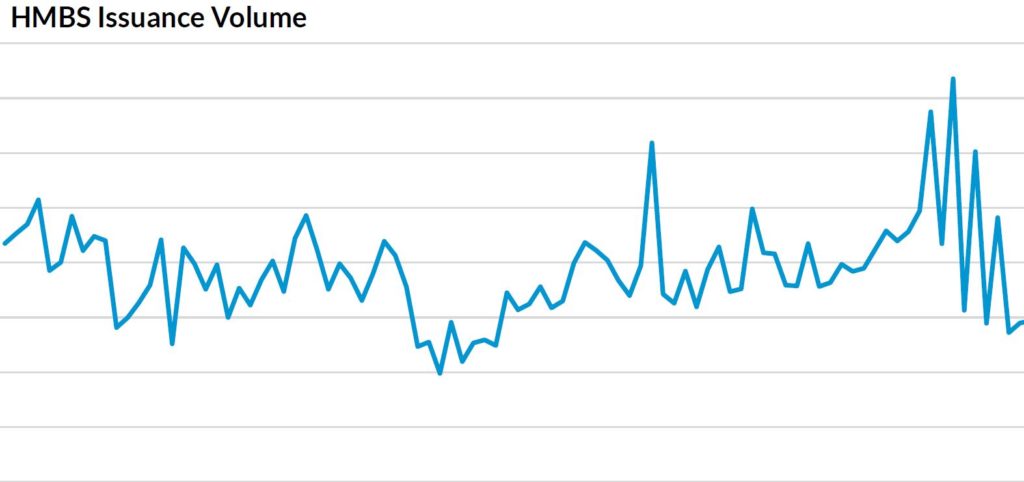

The HMBS new issue market continued to inch up in May. HECM Mortgage-Backed Securities (“HMBS”) issuance totaled $526 million in May, $23 million higher than April’s $503 million. 86 pools were issued in May, versus 89 in April. Nonetheless, HMBS issuance remains near historical lows compared to monthly issuance dating back to 2010.

FAR was the top issuer again in May with $157 million – $2 million more than April’s $155 million. Issuance from Longbridge increased by $11 million to $118 million. Mutual of Omaha and PHH issued $106 million and $85 million respectively. Ginnie Mae/RMF (aka “Issuer 42”) again issued no HMBS pools.

HMBS issuance set a record in 2022, with nearly $14 billion issued. Total issuance for 2023 was approximately $6.5 billion. 2024 is off yet more, with total issuance through May totaling $2.4 billion – $236 million lower than at this time last year and $4.8 billion lower than at this time in 2022.

May’s original (first participation) production of $360 million was $38 million higher than April’s $322 million, and higher than that of May 2023, when approximately $352 million in original new HMBS pools were issued.

The 86 pools issued in May consisted of 22 first-participation or original pools, 63 tail pools, and 1 pool which included both new production and tails. Original pools are those HMBS pools backed by first participations in previously uncertificated HECM loans. Tail HMBS issuances are HMBS pools consisting of subsequent participations. Tails are not from new loans, but they do represent new amounts lent. Last month’s tail pool issuances totaled $164 million, below the typical range.

Notable in the May HMBS issuance data are 22 pools with an aggregate pool size of less than $1 million. Issuers are taking advantage of Ginnie Mae’s provision to issue pools as small as $250,000. This represents $11.4 million of UPB that may not otherwise have been issued in May. Ginnie Mae issued APM 23-11 in September which allows participations from the same loan to be pooled more than once in the same month. The aggregate of participations pooled in May for which more than one participation from the same loan was pooled is $53 million, of which $3 million were first participations.

(Editor’s note: The following article was republished with permission from New View Advisors, which compiled this data from publicly available Ginnie Mae data as well as private sources.)