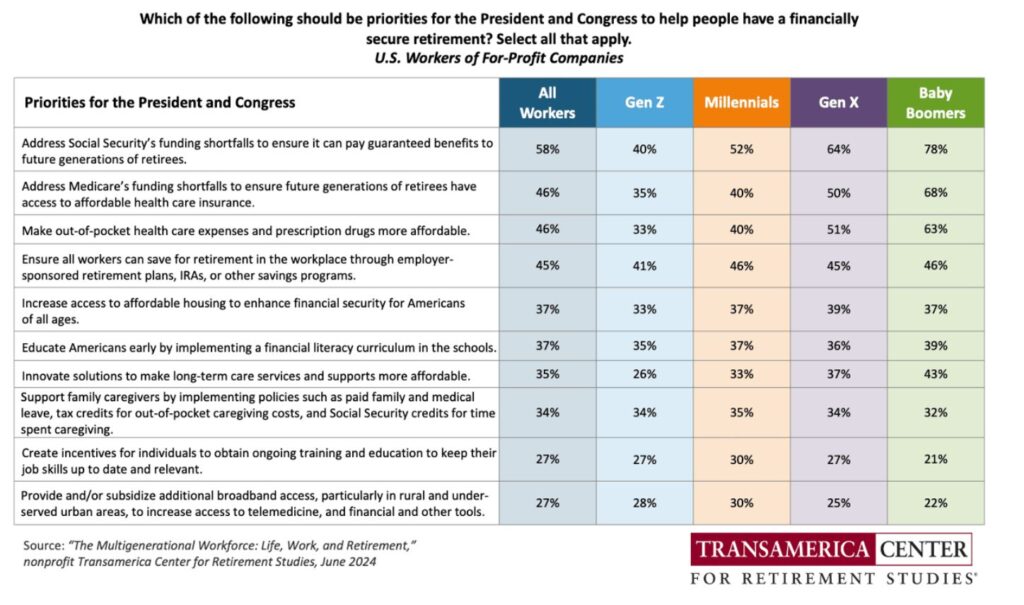

Fifty-eight percent of all workers — including 78 percent of Baby Boomers —believe the President and Congress should address Social Security’s funding shortfalls to ensure the program can pay guaranteed benefits to future generations of retirees. This is according to a new survey conducted by the Transamerica Center for Retirement Studies® (TCRS).

Go deeper: Other priorities identified by Baby Boomers in the survey include addressing Medicare’s funding shortfalls (68 percent), making out-of-pocket healthcare expenses more affordable (63 percent) and ensuring all workers can save for retirement in the workplace (46 percent).

By the numbers: Seventy-three percent of workers are concerned that Social Security will not be there for them when they are ready to retire. Forty-three percent of Baby Boomers and 29 percent of Generation X expect it to be their primary source of retirement income, according to the survey’s findings.

- When asked how Congress should address Social Security’s funding shortfall, workers were lukewarm about possible solutions, such as increasing the maximum earnings subject to payroll taxes (which 40 percent supported), increasing the Social Security payroll tax rate (38 percent), preserving retirement benefit payments for retirees in greatest need (34 percent) and raising the retirement age (23 percent). Just four percent say that Congress should “do nothing.”