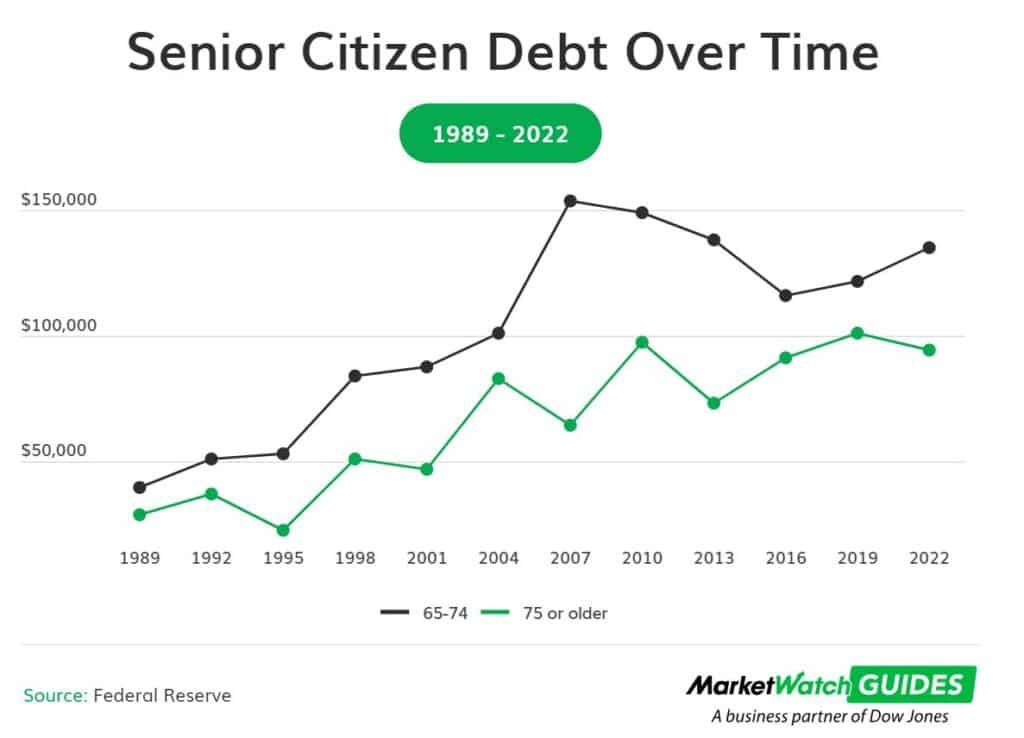

Adults aged 65 to 74 hold an average of $134,950 in debt, while individuals 75 and older hold an average of $94,620 in debt, according to Federal Reserve data analyzed by MarketWatch.

By the numbers: Nearly 65 percent of Americans 65 to 74 held debt in 2022, compared to about half of seniors 75 and older who held debt.

- In comparison, less than half of the population aged 65 to 74 held debt in 1989.

- That same year, only 21 percent of older adults 75 and up were in debt.

Go deeper: Consumers aged 65 to 74 held an average of $175,670 in home loans in 2022, per the Federal Reserve data. Other types of debt included installment loans, car loans, credit cards and medical debt.

- Nearly a quarter of adults aged 75 and older held mortgages in 2022, the highest percentage since 1989. The average mortgage balance among these older adults decreased from $144,910 in 2019 to $138,700 in 2022.